MSP Business

Introduction to Financial KPIs for MSPs

If you're an MSP, you're probably familiar with the concept of Key Performance Indicators, or KPIs, for monitoring the management of software and systems.

But the usefulness of KPI is not limited to the technical realm. Another kind of KPI -- ones based on financial data -- also can play a critical role in monitoring and managing the financial performance of your MSP business. Financial KPIs help MSPs know how many members they need to add to their team, how to set sales commissions, which tools or software to use, and much more.

Keep reading for a primer on financial KPIs and how to use them to help grow and sustain your MSP business.

Main Financial MSP KPIs

Let's start with a list of the main KPIs that you should track for an MSP business. (This list doesn't include every KPI out there; we’ve limited it to those that are most important for MSPs.)

![]()

Revenue

Revenue refers to the total amount of income generated by your company. In other words, it's how much money you collect from selling your products and services. (It doesn't reflect the profit you make; for more on where profit fits in, see the "margin" section below.)

Beyond tracking the revenue as a KPI, you can also track these revenue-related KPIs:

- Recurring revenue: This is the amount of revenue you bring in regularly through subscriptions (as opposed to one-off projects). A monthly managed services contract that brings in $10,000 represents an income of $10,000 in monthly recurring revenue or $120,000 in annual recurring revenue.

- Source revenue: This is the proportion of your total revenue that comes from a specific source. For example, you get $800,000 annually as your recurring services revenue and your total annual revenue is $1,000,000, then your revenue for that source is $800,000, or 80 percent. Tracking source revenue helps you identify which sources are bringing in the most revenue, and allows you to predict cash flow and assess how well-balanced your overall client portfolio is.

For MSPs, MRR (Monthly Recurring Revenue) is often one of the leading indicators of company success.

If you're not happy with your current revenue, you can improve it by focusing on the core fundamentals of customer relations, sales, and marketing. Increasing revenue means, firstly, identifying customer needs, and then developing solutions to address these needs and making sure that your sales and marketing team is promoting those solutions effectively. If your revenue is flat or declining, it's probably because of a failure to align your service offerings with current customer needs, or your sales and marketing efforts are ineffective.

Margin

Margin is a measure of the profit that you make on your services.

Further reading Introduction to MSP Profit Margins

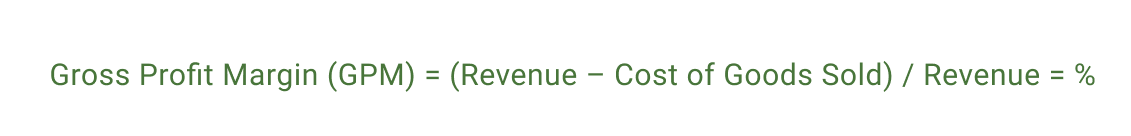

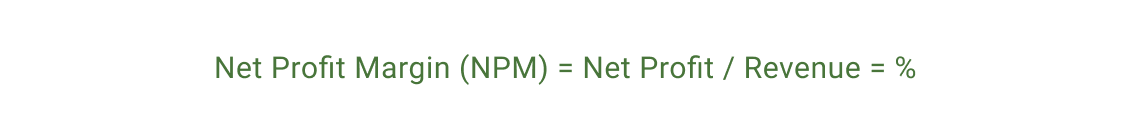

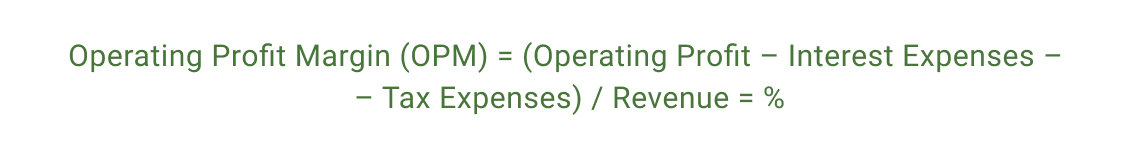

There are three types of margins to track:

- Gross profit margin: This is the income received from your managed services with the direct costs of providing these services deducted, this excludes indirect business expenses such as marketing costs, office rental, or taxes. MSPs usually track gross profit margins per revenue source and per service offering: Because not all revenue streams are equal, you should monitor the gross margins of each revenue stream separately to ensure that your services are delivering the profits that you forecast.

- Net profit margin: This is a measure of the profitability of a business after accounting for all its total costs. The net profit margin indicates how much after-tax profit a business makes for every dollar of revenue it generates.

- Operating Profit Margin: This margin KPI represents the residual business earnings after subtracting out most fixed costs (such as staff costs, rental expenses, advertising and marketing costs, research and development costs).

Cost of Goods & Services Sold

This financial KPI, often called COGS for short, represents the total sum of the labor, material, service and delivery costs that your business incurs directly from delivering its managed services, as well as the costs incurred from overhead expenses such as infrastructure, software, travel, training, and professional service expenses.

COGS that grow too high are a sign that you may be operating your business inefficiently, and you can increase profit margins by adjusting the costs of your staffing, software tools, or other expenses.

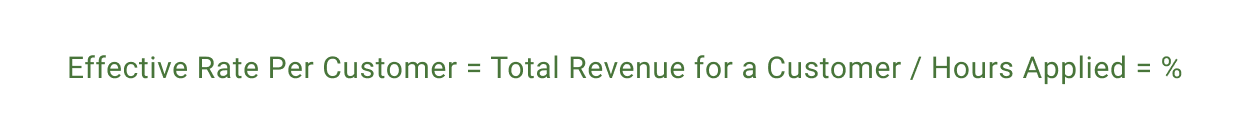

Effective Rate per Customer

This KPI shows which customers deliver the highest per-hour value. In other words, it's a measure of how much revenue you generate from each given client for each hour that you spend working with that client.

This KPI helps you identify the most financially lucrative customers so that you can focus on growing their accounts. It's also a way to identify customers that are not as lucrative so that you can invest your effort on increasing this KPI for those accounts by, for example, educating those customers on the technologies you use to reduce the time you need to spend answering questions for them about everyday tasks.

Effective Rate per Offering

This KPI represents how much revenue you earn from each of your managed service offerings based on how many hours you spend delivering that service.

Like the effective rate per customer, the effective rate per offering helps you determine which types of services are the most lucrative. If a service is not sufficiently profitable, consider finding ways to increase the automation so that you can continue to deliver the same solution but at a lower cost.

Customer Distribution

The customer distribution KPI tells you which clients bring in the most money. It helps you determine which clients are the most important to keep happy. It also enables you to understand the significance of any impact that would be caused by the departure of a particular customer on your MSP business.

Return on Investment (ROI)

ROI is a way of determining how much of a profit you can expect to earn from a given investment (such as offering a new service or buying a new software tool). It helps you evaluate whether any particular investment opportunity is worth pursuing.

How to Choose KPIs that Matter

Determining which MSP KPIs to track is a tricky decision. If you track too many, you run the risk of data bloat (meaning you have more KPI data than you can reasonably work with or put to good use). You end up wasting time collecting data that you never use, and you’re unable to distinguish the important data from the other information that you have.

On the other hand, having too few KPIs leaves you with an incomplete picture of your MSP business’s performance. You may miss valuable insights or fail to foresee future problems.

So, how do you determine which KPIs to track and which to ignore? Here are some pointers:

- Consider how the KPIs you choose can align with your business’s goals, both in the short and long terms.

- Reevaluate your KPIs as your needs change. The KPIs that work one year may become ineffective in the next.

- Consider how your KPIs interact. In some cases, a single data point doesn’t convey all the information you need, but it can be combined with another bit of information to provide valuable insight. For example, if you want to track customer growth, a simple “total customers” KPI wouldn’t be a good measure of this since it wouldn’t consider the varying levels of revenue and profit from each account. In contrast, collecting data points for total customers, total sign-ups over the last thirty days, and customer attrition over the preceding thirty days would provide a far more accurate assessment of your overall customer growth or loss rate.

Using this data, you could then investigate any recent changes or trends that may be contributing to any attrition or growth. Also, comparing KPIs from one year to the next can help you identify any trends that may be seasonal.

To assist further in identifying appropriate MSP KPIs, here’s a checklist you can follow when considering a KPI. If most of the answers to the questions below are yes, it’s a good KPI to track:

- Is the KPI relevant to my team’s, or my business’s, goals?

- Is the KPI necessary for any regulatory compliance requirements?

- Do my employees have any control over the employee performance metric?

- Can I easily measure the KPI?

- Could the KPI be easily abused to distort performance evaluations?

- Does the KPI establish a specific and easy to understand performance goal?

- Does the KPI indicate what I want to know better than any other related KPIs?

- Can I set goals with this KPI that can be met (and measured) in a reasonable timeframe

Conclusion

Collecting and analyzing financial KPIs is a critical step for running a successful MSP business. The specific MSP KPIs that you choose to track will vary depending on which types of services you offer and the current stage of growth of your business. But without KPIs that align with your business goals, you may end up shooting in the dark when it comes to successfully running your business.